Covid versus Call Centers

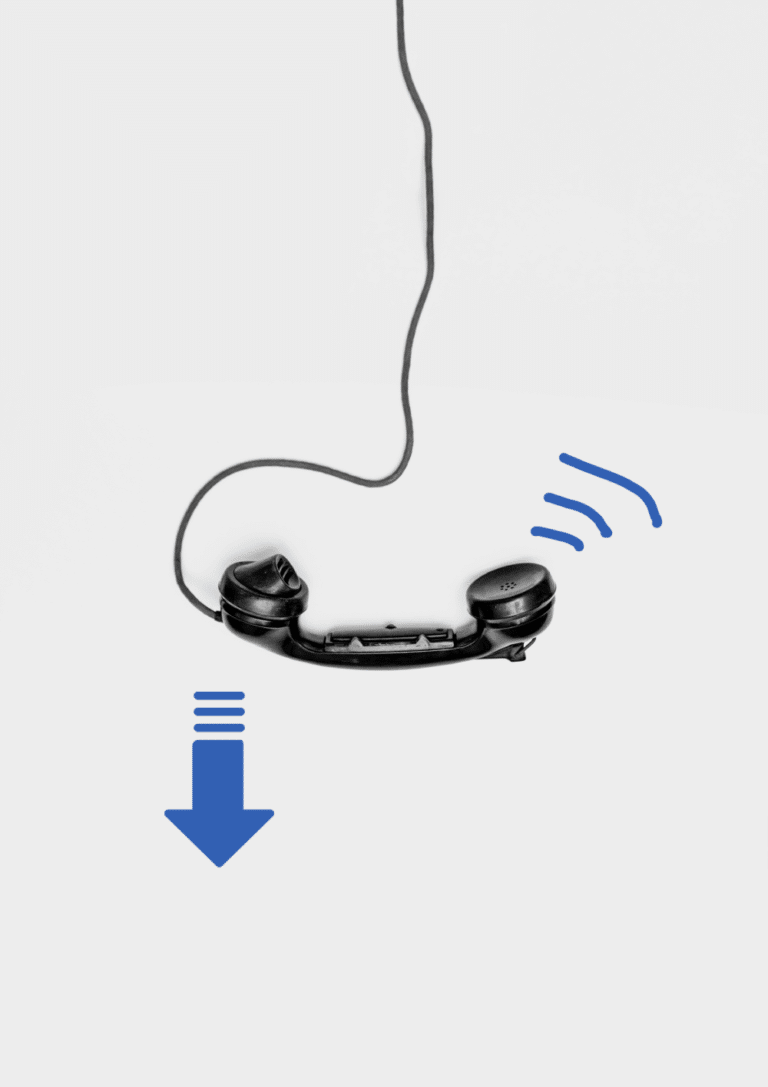

The inability to visit physical offices, branches and stores has created a spike in consumers getting in touch with organizations via their call centers.

600% to 800% increase in call center activity

Cleaned up transaction data enriched with logos and map locations is an effective way to reduce the burden on the customer touch points in a banking organization

20% drop in the capacity of representatives

The Covid-19 crisis has had a “double whammy” effect of increasing demand for call center services along with a loss of call center capacity. Organisations with the inability to allow staff to work from home combined with reduced staffing due to illness both contribute to the loss of capacity.

* Data provided by Pindrop

Covid versus Open Banking

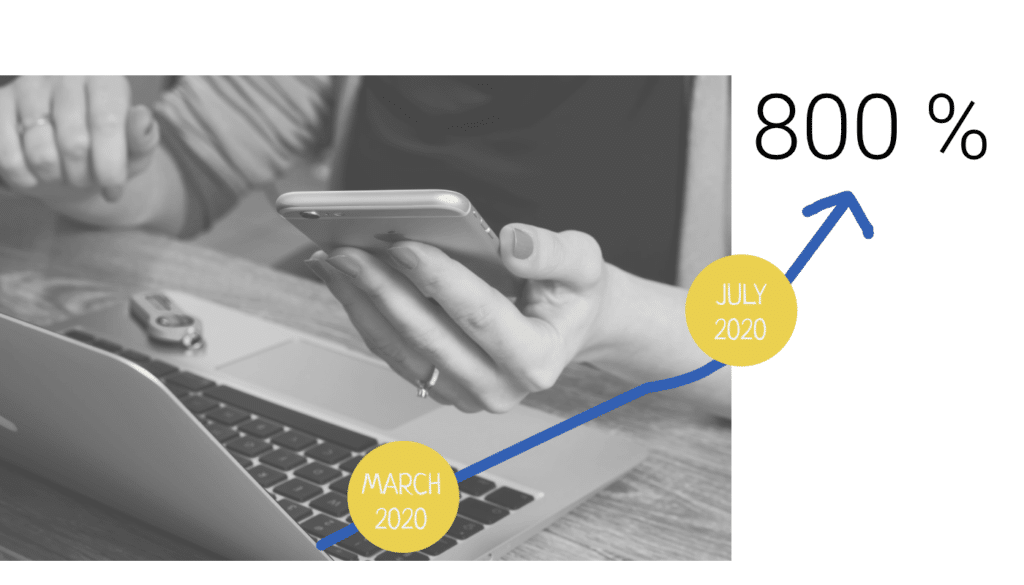

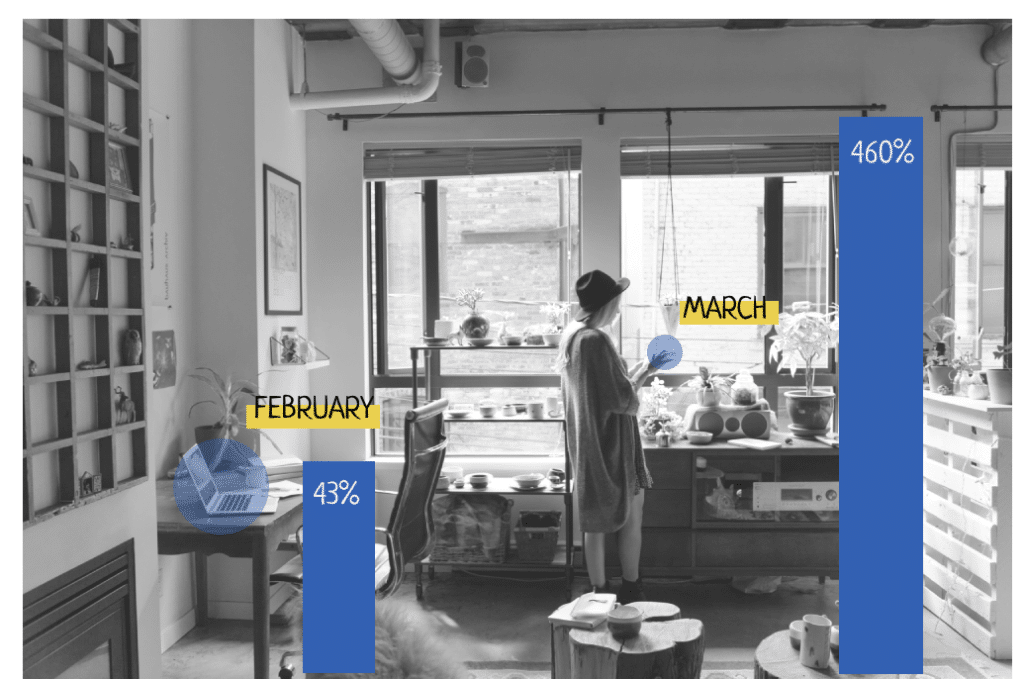

How lockdown has affected the use of initial payments through open banking, according to data provided by TrueLayer

increase in the use of Open Banking for initiating payments

The initiation of payments via Open Banking had been increasing 43% month on month up until February 2020. This increased to 460% in March. Another point is that the research shows that once adopted, usage continues, perhaps demonstrating value in Open Banking.

Finally, 88% of this growth was captured by traditional banks, showing that Open Banking is not just being used by new challenger banks.

* For those unfamiliar, more can be learned about Open Banking from the UK’s Open Banking organisation Web site.